Topic: Art Toy Museum Gallery

The received wisdom in countries like Argentina, with years of painful experience of surviving inflation, is that when prices start to gallop, you invest in bricks and mortar. Or a car. Or consumer durables. Or now, perhaps, art.

On Thursday, the city bank of Buenos Aires, Banco Ciudad, which prides itself on being the country’s top bank in the auctions business, holds its third “super special” auction of the year - and is already bracing itself for a packed auditorium and telephone lines buzzing with bids, amid what it says is a “sustained growth in public interest in investing in art”.

In Argentina, where private estimates reckon inflation will end the year at 25 to 30 per cent (well above the discredited official data, which reports that prices have risen 6.7 per cent so far this year), buying art may be a new hedge.

It could also be a way for Argentines to maintain a sense of sophistication. Argentines gloried in their humble peso being equivalent to the mighty dollar during the 1990s - until the unsustainable currency peg spectacularly collapsed in 2001-02.

Whatever the reason, visitors to the auction section of Banco Ciudad’s website have doubled in the past month and there are 20 requests a day to receive auction catalogues online for bidders to browse the relative bargains on offer.

Reserve prices for Thursday’s auction of Argentine artists start as low as 1,500 pesos ($380) and the biggest ticket work is Vito Campanella’s oil on canvas, “La Payada” , which starts with what the bank calls the “very tempting” price tag of 15,000 pesos ($3,800).

The bank’s first two auctions this year raised more than 4.4m pesos ($1.1m) and artworks have gone under the hammer for more than 50 per cent more than their reserve prices.

This experience in Argentina illustrates a wider trend: the rise of art as a new emerging asset class. Forget bonds, stocks, forex or even copper and soya. Bric art is booming, as this article highlights.

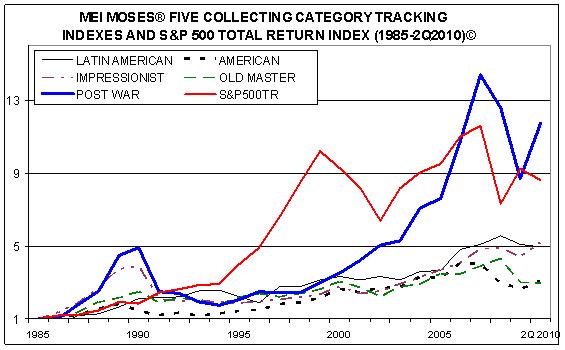

Latin American art was the best performing regional art index in the past 25 years at the end of 2009, according to Beautiful Asset Advisors, whose founders Jianping Mei and Michael Moses track the performance of fine art sales against equity market returns via their MeiMoses fine art indices.

Latin American art’s performance has sloped off this year - the following graph shows how it lags the resurgence in demand for post-war and impressionist works - but it remains “very vibrant and viable, especially as wealth continues to accumulate”, according to Mr Moses.

Castlestone Management, a UK fund manager which last year launched the first retail art fund, offering institutional and individual investors the opportunity to diversify out of traditional asset classes, says that when the value of money falls, the value of art, like that of gold, rises.

As its CEO Angus Murray, puts it, art is “an irreplaceable, unleveraged real asset which responds well in a time when the possibility of inflation is on the horizon alongside the rapid decline of the real purchasing power of money.”

Soaring bid and sales volumes at New York and London auctions since late last year prove confidence in the art market is back. “People haven’t suddenly become cultured, it’s a hedge against inflation and shows art is becoming more and more a respected asset class,” says Constanze Kubern, Castlestone’s senior art adviser.

Though “blue chip” artists can prove costly investments - Pablo Picasso’s “Nude, Green Leaves and Bust” sold for $106.5m in New York in May, setting a new world record - art gets good returns, as the following chart from Castlestone shows:

And there is plenty of upside yet. Castlestone expects art prices to rise 40 per cent over the next couple of years as the market recovers from lows in 2009.

Emerging market and Latin American art was on the up before the 2009 economic downturn, and is now picking up steam again. Phillips de Pury, one of the other big auction house alongside Sotheby’s and Christie’s, held a Bric auction in London in April, and Latin American art was showcased in the Pinta art show in London in June, a expansion from Pinta’s roots in New York.

Bric and Latin art can be speculative and thus risky, and Castlestone doesn’t own any Latin American art yet - it focuses on the “golden middle” of post-war art where prices and returns are good. But Kubern said she had Colombian artist Fernando Botero on her shopping list.

So emerging market investors may want to grab their cheque books and rush to get seats at the October-November auction season in London and New York. And make sure they have enough cash left over for the ArtBasel fair in Miami Beach in December.

Related:

Nigeria’s art collectors: a nice new market, The Economist

The Rise of the Emerging Art Economy, Businessweek